Dear %1,

|

|

|---|

It has been a busy winter here at University Neighborhood Housing Program, with multifamily housing research, ongoing renovation at the West Farms project, and the launching of our fifth season of free tax preparation.

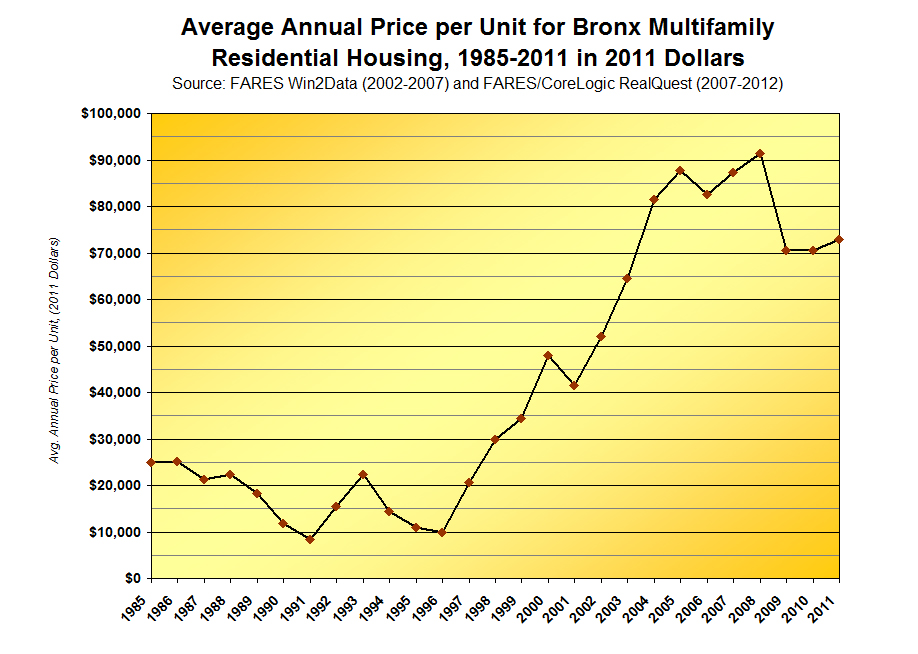

New Building Indicator Project (BIP) data was released to subscriber groups in mid February, tracking levels of physical and financial distress in more than 62,000 multifamily apartment buildings in the Bronx, Brooklyn, Manhattan and Queens. Nonprofit community development and organizing groups will put it to good use in the coming months, and we plan to release portfolio data along with recent sales price data (see chart) to lenders through our Multifamily Assistance Center later this month. We expect both sets of partners to continue using BIP data in their efforts to improve our City’s multifamily housing stock.

Our BIP data was also indirectly referenced in a number of recent Community Reinvestment Act bank examinations, and it played a central role in a recent study by the Citizen’s Housing and Planning Council entitled The Impact of Multifamily Foreclosures and Over-Mortgaging in Neighborhoods in New York City. The report used historical BIP violation data and found that over-mortgaged and foreclosed multifamily buildings increase the risk of deterioration of nearby buildings and raise costs for private owners and New York City in the form of additional Emergency Repair Program (ERP) expenditures. Coverage of the report can be found in the Wall Street Journal, on GlobeSt.com, in Crain’s New York Business, and in City Limits.

Along with our partner Fordham Bedford Housing Corporation, UNHP has been making significant progress in our work to renovate the West Farms project. West Farms is an eight building, 526 unit Section 8 affordable housing complex built in 1973. We began the substantial renovation in May 2011 and the project is now 76% complete. Financing from HUD, HPD, HDC, Enterprise and JPMorgan Chase has been used to acquire the property, renovate bathrooms and kitchens and construct 3 playgrounds (see one of them at left). The energy efficient renovation includes the installation of a Cogeneration or Combined Heat and Power system which will provide both heat and electricity to the buildings and an anticipated 15 to 40% savings in energy costs.

Along with our partner Fordham Bedford Housing Corporation, UNHP has been making significant progress in our work to renovate the West Farms project. West Farms is an eight building, 526 unit Section 8 affordable housing complex built in 1973. We began the substantial renovation in May 2011 and the project is now 76% complete. Financing from HUD, HPD, HDC, Enterprise and JPMorgan Chase has been used to acquire the property, renovate bathrooms and kitchens and construct 3 playgrounds (see one of them at left). The energy efficient renovation includes the installation of a Cogeneration or Combined Heat and Power system which will provide both heat and electricity to the buildings and an anticipated 15 to 40% savings in energy costs.

UNHP launched our 2012 tax season in January and we have already assisted close to 750 low income Bronxites file their taxes for free. UNHP’s tax program is a collaborative effort with Ariva, Fordham Bedford Community Services and volunteers from Fordham University and Manhattan College. Our tax program provides a professional alternative to high priced tax preparation businesses and even higher cost refund anticipation loans and checks. Last year, UNHP assisted more than 1,000 low income households and facilitated $1,376,646 dollars in total returns. The average Earned Income Credit return was $1,998 and most filers earned less than $20,000 per year.

The following are a few stories about our 2012 clients and the ways they plan to use their refunds.

Save some and travel some

Charmaine R. lives on Barnes Avenue in the Bronx and works full time at a medical office earning just over $17,000. Charmaine filed her taxes for free with University Neighborhood Housing Program in January and was very happy to learn about her sizable expected refund. Charmaine is a single Mom with a school–age daughter. Because Charmaine is low income and has a dependant, she qualified for the Federal Earned Income Tax Credit and will receive over $7,000 in her refund. She will put at least $4,000 into savings for her daughter’s future and use some of the refund to buy essentials for her family. She plans to use the balance to take her daughter on a trip to Jamaica where she has many friends and family.

Go for a Sushi dinner

Cheri J. is a 55 year old retired word processing assistant and currently lives on social security for her income. She used to work for Citicorp and the New York Times, but no longer has any retirement income from these work places. Cheri lives in the same Fordham Bedford community where UNHP has their offices. She is active in the community volunteering her time at the local thrift shop, community garden and with senior citizens. She is also active in the fight to keep a local post office open. Cheri sought out free tax preparation services because she only gets a small refund from the state for the NYC school tax and paying for tax preparation would not make financial sense. While the $63 she gets back on her refund is not that much – it is enough to take her grown daughter out for a sushi dinner.

Pay Car Insurance

Warren T. is a proud member of Local 3 – the electrician’s union. Warren was a full-time paid electrician at the World Trade Center until September 11 and since that day has struggled to find a job as good as the one he had. Warren has worked in temporary positions for a number of companies including ABC, the NYTimes, Wellsbach Electrical and JPMorgan Chase. He had been on unemployment for the past two years and his benefits just expired. Warren is a single father of two children; His daughter is a graduate of Trinity College who is currently pursuing her Masters at Lehman and his son is in Kennedy High School. Warren has applied for and is hopeful about getting a job as an electrician in a large Bronx condo real estate project. Warren used UNHP’s Free Tax Preparation Program in January on the recommendation of a friend. Though he had used Jackson Hewitt in the past, he was happy to save the fees with UNHP. Warren was also happy with the professional service he received at the UNHP tax site. He will receive over $400 back in a refund. Warren plans to use the refund to purchase car insurance for the year so he can keep his car to travel to his next job.

An Enjoyable Experience

Like many of our filers, Orlando R. came to UNHP after paying “too much” to get his taxes prepared in the past. Orlando, a Kingsbridge resident, has known financial hardship and is back to work after losing his job in 2009. Currently working for a transportation company, Orlando supports his wife, Sonia, and two grandchildren, ages six and five. Though he was initially skeptical about a program offering free tax preparation, he found the experience to be both professional and enjoyable. Orlando and Sonia qualified for $4,374 in Earned Income Tax Credit giving them a return of $2,952 from the state and $7,374 in their federal return. Orlando and his wife Sonia will use part of their refund to pay bills and the rest will go toward their grandchildren and their education. Orlando was grateful for the help of our volunteers and told us, “I would recommend this place to everyone.” Orlando also encouraged his adult son to file with us this year.

During tax season, University Neighborhood Housing Program goes mobile, bringing our free tax preparation services to local low-income senior housing developments like Rose Hill Apartments, Serviam Gardens and Edison Arms. In December 2009, UNHP completed a substantial renovation of the Rose Hill Apartments, the nine-story, 119-unit building adjacent to Fordham’s Bronx campus.

Just Down the Hall

Chau N., a senior citizen and Vietnamese refugee, previously travelled from her Bronx home to Brooklyn in order to file her taxes. This year, UNHP’s mobile tax team came to her and her neighbors at Rose Hill Apartments, an apartment building for low income seniors and disabled persons. In past years Chau took public transportation to Brooklyn and waited outside in the cold to be seen by another free service provider. Though this yearly trek to Brooklyn pales in comparison to her journey to the United States, she was grateful to only have to walk down to her building’s community room to get her taxes done this year. Chau was a part of a group of refugees who escaped Vietnam by boat during the communist era. A self-described “boat person” Chau and her companions spent days floating aimlessly without food or water before being rescued by a passing ship. Chau plans to use her $378 refund for food and general living expenses, along with some shopping.

A Fan of UNHP’s Programs

Denise M. graduated from UNHP’s financial education five class series in December 2011. “I love learning about what can change and make life better for me and my family.” Denise found out about UNHP’s Free Tax Program from the workshop and made an appointment. Denise had not filed her taxes for 2010 because of the high cost of tax preparation – imagine her happiness at getting a refund for over $25,000 for 2010 and 2011 combined! Denise earns $28,000 in her job with  the City, is raising her three grandchildren ages 12, 13 and 14 and qualified for the Earned Income Tax Credit which provided an $8,940 boost to her refund. Denise has known financial struggles in the past as she was unemployed for 8 years and even now supporting three grandchildren on her salary is challenging. Denise is taking into account what she learned from the financial education classes when thinking about what she wants to do with her refund. Denise is “very pleased with the UNHP staff as well as learning about making a financial change. I will work with UNHP as long as I can and introduce my friends and family to them to help with their finances.”

the City, is raising her three grandchildren ages 12, 13 and 14 and qualified for the Earned Income Tax Credit which provided an $8,940 boost to her refund. Denise has known financial struggles in the past as she was unemployed for 8 years and even now supporting three grandchildren on her salary is challenging. Denise is taking into account what she learned from the financial education classes when thinking about what she wants to do with her refund. Denise is “very pleased with the UNHP staff as well as learning about making a financial change. I will work with UNHP as long as I can and introduce my friends and family to them to help with their finances.”

Denise also attended UNHP’s small business workshop hosted with Project Enterprise on February 23rd at Concourse House. Over 20 independent contractors, at-home entrepreneurs and small business hopefuls attended this workshop. UNHP is making office space available to Project Enterprise to provide assistance to local residents interested in improving or starting up their own business and booked four appointments for one-on-one follow up out of the workshop.

As we move into the spring, UNHP will continue with our work to improve distressed multifamily housing, and preserve affordable housing. UNHP will also move forward with new partnerships with the Parodneck Foundation, The Financial Clinic, Project Enterprise and the Neighborhood Trust to bring a variety of resources to the residents of the Northwest Bronx including foreclosure prevention counseling, financial education, small business help and financial counseling. Thank you for your interest in our work.

Sincerely,

James Buckley

University Neighborhood Housing Program

University Neighborhood Housing Program